YE Bin:An FTA to manage and improve EU – China trade relations

The TPP (Trans Pacific Partnership) and the TTIP are considered to establish new trade rules for the 21st century outside the multilateral trade regime. China is actually excluded in the so called new round of trade rules making. An observer said the TPP has depicted as an anti-Chinese tool whose goal is to create an economic “containment belt” around China.[1] The TTIP and the renascent EU-Japan FTA negotiation seems that the EU is going to follow the exclusion way. Whatever the sort of comments is right or not, as the most booming engine of global growth and the extremely huge potential market, China cannot be really excluded at last. Following a China-South Korea FTA being signed on 1 June 2015[2], Australia also formally concluded an FTA with China on 17 June[3], only 16 days later than the former. The two treaties are deemed as high-level, high-quality and balanced FTAs by Chinese trade officials. The Chinese government is pursuing to catch up with new trade rules. China is also seeking an FTA with the EU. The future EU-China FTA should not only focus on eliminating tariff but also pursuing to decrease non-tariff barrier and promote sustainable development, which is more ambitious than any current China FTAs. 1. China’s ambition to accept high-level, high-quality and balanced trade rules The China-South Korea FTA includes areas such as finance, telecommunications as well as so-called ‘twenty-first century new issues’ related to the environment, labour and competitive neutrality. The China-Australia FTA also stipulates market access, investment and trading rules and related standards. In an interview the Minister of Commerce of China, Mr. Hucheng Gao, said that the high-level, high-quality and balanced China-Australia FTA indicates they can carry out FTA negotiations with any nation or region.[4] According to a statistics, South Korea was the fifth trading partner of China in 2013 and Australia was the sixth.[5] Total trade of both countries with China counted 9.7% of share in China’s trade with world in 2013. In the mean time the total trade of EU with China counted 13.4% of that share. The two FTAs together will bring more than 2% GDP growth for China. So far, China’s FTAs has covered nearly 30% of China’s total foreign trade. Besides the more than 20 existing FTAs and several ongoing FTA negotiations, for example RCEP and ‘Asean+6’, the Chinese government is planning to establish a high-standard FTA network for implementing “One-Belt-One-Road Initiative”.

The TPP (Trans Pacific Partnership) and the TTIP are considered to establish new trade rules for the 21st century outside the multilateral trade regime. China is actually excluded in the so called new round of trade rules making. An observer said the TPP has depicted as an anti-Chinese tool whose goal is to create an economic “containment belt” around China.[1] The TTIP and the renascent EU-Japan FTA negotiation seems that the EU is going to follow the exclusion way.

Whatever the sort of comments is right or not, as the most booming engine of global growth and the extremely huge potential market, China cannot be really excluded at last. Following a China-South Korea FTA being signed on 1 June 2015[2], Australia also formally concluded an FTA with China on 17 June[3], only 16 days later than the former. The two treaties are deemed as high-level, high-quality and balanced FTAs by Chinese trade officials. The Chinese government is pursuing to catch up with new trade rules.

China is also seeking an FTA with the EU. The future EU-China FTA should not only focus on eliminating tariff but also pursuing to decrease non-tariff barrier and promote sustainable development, which is more ambitious than any current China FTAs.

1. China’s ambition to accept high-level, high-quality and balanced trade rules

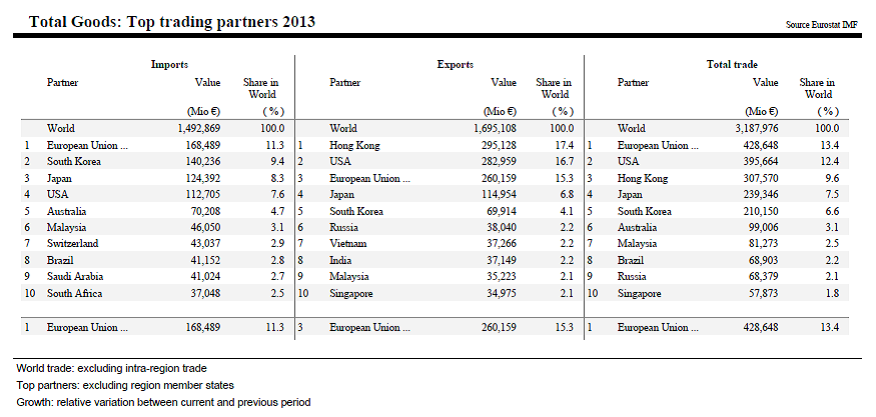

The China-South Korea FTA includes areas such as finance, telecommunications as well as so-called ‘twenty-first century new issues’ related to the environment, labour and competitive neutrality. The China-Australia FTA also stipulates market access, investment and trading rules and related standards. In an interview the Minister of Commerce of China, Mr. Hucheng Gao, said that the high-level, high-quality and balanced China-Australia FTA indicates they can carry out FTA negotiations with any nation or region.[4] According to a statistics, South Korea was the fifth trading partner of China in 2013 and Australia was the sixth.[5] Total trade of both countries with China counted 9.7% of share in China’s trade with world in 2013. In the mean time the total trade of EU with China counted 13.4% of that share. The two FTAs together will bring more than 2% GDP growth for China.

So far, China’s FTAs has covered nearly 30% of China’s total foreign trade. Besides the more than 20 existing FTAs and several ongoing FTA negotiations, for example RCEP and ‘Asean+6’, the Chinese government is planning to establish a high-standard FTA network for implementing “One-Belt-One-Road Initiative”.

China, Trade with World

In 2013, China expressed a desire to join new plurilateral agreement on trade in services, the so-called TISA.[6] After President Xi Jinping visited Brussels in 2014, the EU publicly supported for China joining the talks because Chinese government had reassured to meet and accept the objectives and the level of ambition of the TiSA negotiations. [7] The commitment to accept the TiSA negotiations signifies that China has ambition to accept new trade rules and looking forward to promoting further liberalization.

2 Why China need an FTA with the EU?

China may be on track to become the world’s biggest economy within the next 10 years, with an internal market of 1.39 billion potential consumers by the end of 2015. Bilateral trade in goods between the EU and China reached 428.1 billion euro in 2013. Most of trade issues are regulated by the WTO rules. Two bilateral EC-China trade agreements concluded in 1978 and 1985 are actually outdated.

The trade chapter in PCA negotiation between the EU and China has been actually shelved since over ambitious aims engaged in one negotiation made the whole deal getting into stalemate. Since 2012, China has turned to propose an FTA with the EU. However, so for EU reactions to the Chinese proposal have been only lukewarm. [8] The EU is regarding whether the ongoing EU-China BIT can be achieved as a condition to further consider a so-called deep and comprehensive FTA.

Why China need an FTA with the EU? There are two interrelated reasons.

(a) China needs new trade and investment rules to deepen and promote its domestic reform. In current agenda of China economic reform, New FTAs are an important carrier and breakthrough.[9] During the course of China’s reform, the WTO rules which introduced since China’s access to the WTO since 2001 have acted as a catalyst for transforming China from a centrally planned economy to a market economy. To some extent, the direction of China domestic reform dominated by the central government matches the trend of international trade liberalization and sustainable development. Although some standards in the new generation of EU’s FTA are too high for China, with the slower economy becoming “New Normal” and the industrial upgrading in China, those sustainable clauses such as environment protection, IPR protection, competition neutrality, and labour protection which might be implemented under some condition will play positive and significant functions for China’s sound growth in the future. For example, to implement China’s innovation policy it needs higher IPR protection in its internal market. The sectors which are dominated by state-owned or state-run enterprises need reform to introduce more fair competition for domestic and foreign private investors. The emerging middle and upper class in China also request the government to fight against environmental pollution and climate change.

(b) China needs to engage in the new round of trade rules making. The EU is supposed to be the best potential partner to negotiate a high-level, high-quality and balanced trade FTA. The EU who has got high prestige in promoting free trade, environment protection, and good governance is the biggest trade partner of China. European model of social market economy is much interested for some Chinese policy makers. Compared with the USA, the European Union is generally deemed as a soft power or normative power by Chinese observers. And Chinese consumers are weighted in favour of European more cautious rules, such as food safety regulations on hormone foods or genetically modified foods. Last, but not least, the future EU-China FTA shall decrease trade diverse resulted by other EU’s FTAs concluded with the third partners, for example, South Korea and Canada.

The new trade rules also have the functions to restrain the government’s power to intervene the economy. A high level EU-China FTA would also promote the rule of law in China.

According to a preliminary study, an ambitious EU-China FTA could give a boost to annual trade of up to nine per cent which could reach €0.89 trillion by 2020.[10]

3. To manage trade relations under an EU-China FTA

A high-level EU-China FTA should be designed to manage bilateral trade frictions. Another major function of the FTA should be able to resolve the major problems concerned by European companies and Chinese companies.

(a) Alternate channel to resolve bilateral trade disputes

Trade frictions between the EU and China are the major issue in bilateral trade relations. According to the WTO Trade Policy Review Report on European Union in 2011, almost 45% of anti-dumping measures launched by the EU were applied to China.[11] On 20 March 2014 the EU had 52 anti-dumping measures and three anti-subsidy measures in force against Chinese imports. Currently, settlement of trade disputes entirely relies on multilateral quasi-judicial DSS. Since WTO DSS being more and more overloading, there are many cases remaining unresolved or even unaccepted. Therefore, the dispute settlement mechanism in an FTA could provide alternate channel to resolve bilateral specific trade disputes. Such clauses as Consultations, Mediation Mechanism and Establishment of the arbitration panel in NAFTA Chapter 19 process[12], the EU-South Korea or the proposal TTIP text[13] can be modelled by the future EU-China FTA.

In the solar panel case at last year, consultations through high diplomatic channels played a vital role to smoothen the biggest EU-China trade frictions in history. The future EU-China FTA should include an insitutionised and flexible consultations process.

(b) The WTO- extra and WTO-plus clauses introduced to satisfy the major concerns of European Companies and Chinese Companies

The major problems concerned by European companies on China include the IPR problem, public procurement market, non-tariff barriers and market access.[14] The most concerned problems by Chinese companies on Europe include technical trade barriers, complicated EU level and national legal system and rules, and market access as well. With the WTO- extra and WTO-plus clauses, an FTA may constitute a supplement to the WTO rules to regulate EU-China bilateral trade relations. Upon China’s ambition to conclude high-level, high quality and balanced trade rules, non-tariffs barrier, the IPR protection and environment protection might be included in the talk.

Concerning to the tariff eliminating, the EU might immediately benefit from China eliminating tariffs on cars, luxury goods or some agricultural products. In the China-South Korea FTA, China commits to eliminate 90% categories of manufacture products with several stages, which accounts 85% amount of imports in 2012. For agricultural and fishery products, China will eliminate 93% categories, which accounts 65% China amount of imports.

4. The ongoing EU-China BIT talk

Before the EU-China BIT talk, China committed to give the EU investors pre-establishment national treatment and to use negative list approach to open investment market. These commitments signify the EU-China BIT will be a high level investment treaty. The EU-China BIT is looked as a symbol for the emerging global BIT 2.0.[15] Both the EU and China are striking a balance between the protection of investors and the right to regulate.

Pre-establishment national treatment commitment means China will abandon its thirty years old investment approval system. China’s Ministry of Commerce (MOFCOM) is soliciting comments to entirely amend Chinese foreign investment law. The Discussion Draft generally is seen as a welcome change to China’s existing legal system and embodies an expected trend to rationalize China’s foreign investment regulatory regime in line with prevailing international practice. [16]

Negative list approach will prevent authorities from setting up new market threshold. Except the negative list and application of exception clauses, the contracting party shall not be permitted to decline its original market commitment. Therefore, negative list approach is comparably transparent than positive list. The problem is both China and the EU has had a little experience in introducing negative list approach.

In the EU-Canada FTA (CETA), the EU adopts negative measure list and negative sector list. The CETA excludes sectors such as air service, audio sever and cultural service. The national and regional sector lists in the CETA are really long and complicated. The sector list in the EU-China BIT might be the shorten version of negative sector list of China (Shanghai) Pilot Free Trade Zone or the Catalogue of Industries for Guiding Foreign Investment promulgated by National Development and Reform Commission and Ministry of Commerce. The gradually decreased negative list of Shanghai Pilot FTA is deemed as the pilot example for the China-US and China-EU BIT talks. According the latest Catalogue of Industries for Guiding Foreign Investment amended in 2015, the category of sector shall not open has been declined from 79 to 38. The category of sector shall be joint venture or joint cooperation has been eliminated from 43 to 15. The number of sectors should be controlled by Chinese party has decreased to 35. And e-commerce, chain business and direct selling have been excluded from the negative list. Since the China-South Korea has included clause on finance services and telecommunication, the EU-China BIT might also include the two key markets access.

Observed from the measures list in CETA, the difficulty in the EU-China BIT talk would be whether or how to exclude performance requirements, for instance, percentage of domestic content; restrict sales of goods or services or transfer technology and so on.

With regard to the dispute settlement between investors and states (ISDS) in the BIT, it seems both sides are going to inform the existing arbitration system by introducing an appeal system in the future.[17] The EU’s proposal for establishing an International Investment Court might be supported by China.

4. Conclusion

China has ambition to accept high level trade rules to promote its transforming. European style trade rules or European standards would be engaged in current China’s reform agenda. An EU-China FTA would benefit both sides. For China, it would be a catalyst to deepen economic reform, a guard for its free and fair market economy and an instrument for improve rule of law. However, The EU might be losing the best timing to accept China’s FTA proposal because there are signs that the China-Japan-Korea FTA negotiations will be resumed.

(Contant Ye Bin:yebin@cass.org.cn)

--------------------------------------------------------------------------------

[1] Financial Times, “It won’t be easy to build an ‘anyone but China’ club”, 22 May 2013, available at http://www.ft.com/cms/s/0/08cf74f6-c216-11e2-8992-00144feab7de.html

[2] http://fta.mofcom.gov.cn/article/chinakorea/koreanews/201506/21859_1.html

[3] http://news.xinhuanet.com/fortune/2015-06/18/c_127929682.htm

[4] Interview: Gao Hucheng, 2015, see http://www.ifforum.org/en/index.php?m=content&c=index&a=show&catid=144&id=160

[5] Source Eurostat IMF.

[7] http://europa.eu/rapid/press-release_IP-14-352_en.htm

[8] Roberto Bendini, “Trade and Economic Relations with China 2014”, DG EXPO/B/PolDep/Note/2014_101, May 2014.

[9] It was the first time that the term, "high-standard" FTAs, was used in a Chinese Government Work Report. This can be seen as a sign of China openness toward, if not increasing interest in, the United States-led Trans-Pacific Partnership (TPP) talks, among some other deals it is negotiating. see http://www.chinadaily.com.cn/business/2014-03/12/content_17343255.htm

[10] Chi Fulin, China-EU think tank alliance could boost trade relationship, 30 June 2015, see https://www.theparliamentmagazine.eu/blog/china-eu-think-tank-alliance-could-boost-trade-relationship.

[11] Trade Policy Review Report by the WTO Secretariat: EUROPEAN UNION, Revision, 2011.

[12] See David A. Gantz, Regional Trade Agreements: Law, Policy and Practice, Carolina Academic Press, 2009, pp. 133-139.

[13] TTIP - Text proposal on Dispute Settlement Brussels, leaked text, 11 February 2014.

[14] http://ec.europa.eu/trade/policy/countries-and-regions/countries/china/

[15] Wenhua Shan and Lu Wang, “The China-EU BIT and the Emerging ‘Global BIT 2.0’”, ICSID Review, Vol. 30, No.1, 2015, pp. 260-267.

[17] Yongjie Li, “Factors to be Considered for China’s Future Investment Treaties”, in Wenhua Shan and Jinyuan Su (eds), China and International Investment Law: Twenty Years of ICSID Membership, Martinus Nijhoff Publishers, 2014.