An EU Opening: China Stands Ready to Increase Investment in Central and Eastern European Countries

Strengthened ties between China and Central and Eastern Europe (CEE) were a highlight of Sino-EU relations in 2012. During his trip to the region in April, Chinese Premier Wen Jiabao put forward 12 proposals to promote Sino-CEE friendship and cooperation. On September 6, Beijing hosted the Inaugural Conference of the China-CEE Cooperation Secretariat. With the fast growth of economic and trade cooperation between China and CEE, flourishing Chinese investment in the area has helped stimulate the further development of bilateral relations.

At a meeting of the China-CEE Cooperation Secretariat in Beijing on December 19, China's Vice Foreign Minister and Secretary General of the secretariat Song Tao said that with their cooperation still in its infancy, China and CEE should continue to expand collaboration in 2013 by maintaining high-level exchanges and launching new initiatives to accommodate future developments.

In the coming year, Chinese investors are expected to seize opportunities to establish a greater business presence in CEE.

Window of opportunity

The Greek sovereign debt crisis has triggered continuous turmoil in the euro zone and exerted significant influence on the economic development of CEE. In the midst of this challenging situation, the area offers China a "window of opportunity."

The debt crisis has altered the investment climate in CEE. The World Investment Report 2012, released by the UN Conference on Trade and Development (UNCTAD), noted that against the backdrop of sustained economic uncertainties in Europe, continued instability in global financial markets and the slowdown in most emerging economies, many countries have adopted foreign direct investment as a way to promote growth and made their investment environment more conducive to foreign investors.

Countries in CEE, in particular, are using investment promotion as a means to spur economic growth. A 2012 survey of multinational corporations conducted by UNCTAD showed that the new EU-12 countries (10 countries in CEE plus Cyprus and Malta) have become some of the world's top investment destinations.

Moreover, following the impact of the debt crisis, euro-zone countries such as Greece and Italy struggled to maintain their presence in CEE, resulting in a large number of poorly managed assets, which provided opportunities for foreign investors to step in. Meanwhile, the spillover of the euro-zone crisis has seriously affected the economic growth and social stability of CEE, which used to turn primarily to Western countries for investment, but are now "looking both eastward and westward," seeking closer cooperation with Russia and China to promote economic growth. In light of its good investment foundation in these industries and abundant foreign exchange reserves, countries in CEE are vying to attract investment from China.

It should be emphasized that the major factor affecting changes in the investment environment of CEE is the European debt crisis. As such, the future of the crisis will directly affect Chinese investment in the region. The grimness of the situation is likely to ease in the near future due to internal structural adjustments however. As a result, the interaction with and even control over CEE by euro-zone countries will be restored and investment opportunities for external countries will gradually diminish.

China should make the most of these opportunities before it's too late. Investing in CEE helps China upgrade export products and extend its investment value chain. The European debt crisis has shrunk the real economies of EU countries and caused a decline in import demand. These trends have taken a toll on the EU's imports from China. Since mid-2010, the growth rate of exports to the region has continued to decline. Worse yet, such exports registered negative growth in 2012—down 1.8 percent, 0.8 percent and 5.6 percent in the first three quarters respectively year on year, according to China's Ministry of Commerce.

The slowdown in the growth rate of China's exports is the result of declining competitive advantage. The competitiveness of labor-intensive exports from China has long been in decline in the EU market, and even the competitive advantage of capital-intensive machinery and equipment exports barely exists now. To buck this downward trend, China cannot wait for the EU economy to recover to offset its losses. Instead, it should focus on enhancing the competitiveness of its exports to the EU and moving its products further upstream on the value chain. Speeding up the upgrading of the export industry by increasing investment in Europe has become a new way to compensate for negative growth in China's largest export market, as well as to drive its own economic growth.

Multiple fields

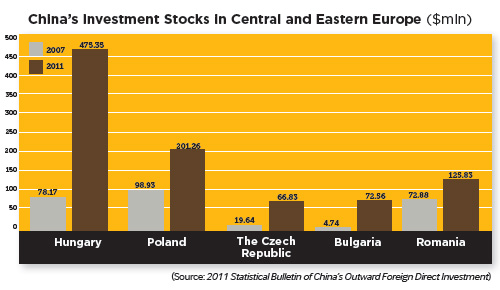

China's investment in infrastructure construction in CEE has maintained a sturdy momentum. The China Road and Bridge Corp. signed a contract with the Serbian Government to build a bridge across the Danube River in April 2010, a landmark project in bilateral cooperation. Chinese information and communications technology companies such as Huawei and ZTE have invested across CEE. China has also accelerated capital and technological investment in hydropower stations, nuclear power plants and thermal power stations in the region. In terms of machinery processing and manufacturing, China has invested in the production lines of electrical appliances, automobiles and heavy machinery in countries such as Hungary, Poland, Bulgaria and Serbia.

At the end of January 2012, Liuzhou-based Liugong Machinery Corp. acquired the Polish construction machinery enterprise HSW, one of the largest such manufacturers in CEE with a highly respected international reputation in the heavy engineering equipment sector. With the acquisition of HSW, Liugong can now extend its influence to the full European market.

As part of its efforts to integrate the above-mentioned competitive industries, China has also strengthened the construction of industrial parks in CEE so as to encourage and expand the influence of Chinese investment in the region. In the future, China will play an increasingly important role in the privatization of large state-owned financial, telecommunications, energy and power companies in CEE countries, acting as a major participant in their pillar industries.

China's main investment approach in CEE is to move its entire industrial chain to the region and build it into a product upgrading as well as a sales center, so as to realize the localization of the production, flow and trade. Nevertheless, investment risks remain. Some members of the European Parliament have stated that China will be welcomed if its investment provides employment opportunities and profits, but it will be met with strong opposition if it wants only to use CEE as an export base and sales center. Competition between China and some countries in the region cannot be ignored. For example, both Poland and Hungary feature processing industries regarded as the miniatures of China in the EU market.

In addition, China is less familiar with countries in CEE after their political transitions. Since the early 1990s, the priority of these countries has been to consolidate democracy, integrate with the West and join the EU. China is mainly engaged in developing its economy and maintaining social stability. China and these countries used to be close; however, they became estranged from one another due to their different strategic development orientations after the end of the Cold War. There are different languages, cultures, ethnic groups, religions and histories in CEE, creating factors that make it more difficult for China to fully understand the region's investment environment.

http://www.bjreview.com/world/txt/2013-01/07/content_510717.htm

(Contact Liu Zuokui:liuzk@cass.com.cn)

- Back _articles: Chinese investment in the EU: a win-win game A view from China (Jiang Shixue)

- Next _articles: A Look Back at 2012 China-EU Relations (Tian Dewen)